First-time buyer scheme is driving demand and supply is following – but industry needs certainty on its future

The number of planning permissions granted in the year to June was the highest for a 12 month period since 2006 when HBF and Glenigan started the Housing Pipeline reports. Driven by strong demand for new homes from the Help to Buy scheme permission for 321,982 new homes were granted in the most recent 12 months.

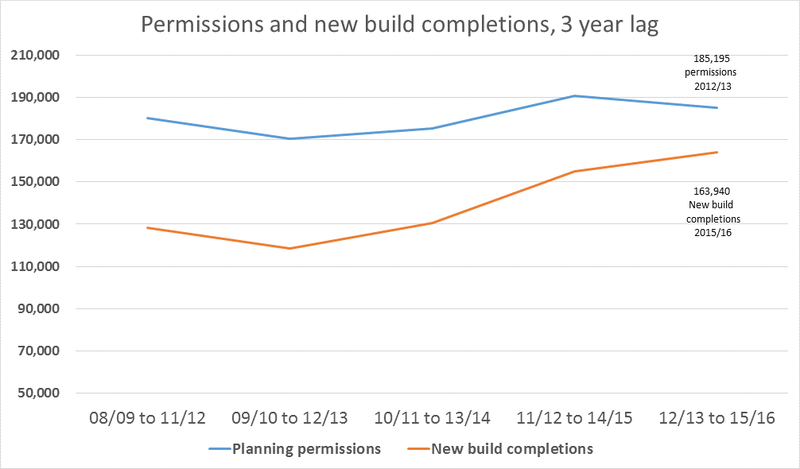

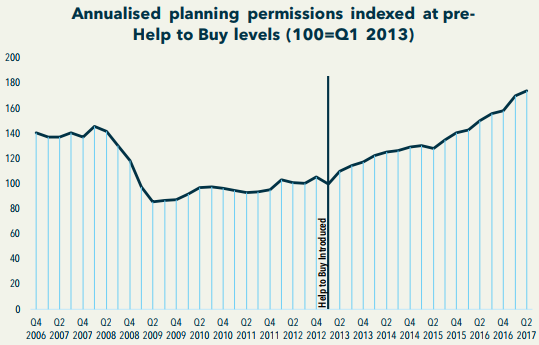

There is a strong correlation between planning permissions granted today and new homes completions two to three years down the line (see graph 1 below) and the figures demonstrate the confidence of builders as first-time buyers continue to use the Help to Buy scheme to get on the housing ladder. (Graph 2 below shows how permissions have increased since the scheme was introduced.) Over 200,000 people, the vast majority first time buyers, now live in a new build home as a result of the Help to Buy scheme that was introduced four years ago.

The industry is urging Government to clarify the future of the scheme beyond its current expiry date of 2021, with investment decisions on land, training and supply chains increasingly needing to factor in whether the scheme will still be supporting sales. Help to Buy has helped the new build sector and the first-time buyer segment of the market to buck the generally slower wider housing market.

‘Stepping up’, an HBF report looking at the impact the Help to Buy scheme has had on the housing market, shows that the scheme now accounts for 1 in 12 of all households making their first steps on the housing ladder and is driving industry confidence to invest in new sites at a time when activity in the market generally remains stubbornly slow.

Over 170,000 jobs continue to be supported by the homes built each year with support from the Help to Buy scheme; and housing supply has increased by 50% since its introduction in 2013.

A strong pipeline of planning permissions is essential if builders are to further increase build out rates. If permissions can be processed quickly to the point where they can be built, it will enable builders to speed up work on existing sites confident that their next sites will be ready to move on to.

Whilst the overall number of planning permissions is at a high, there are still concerns as to how long many of these permissions will take to process to the stage they can actually be built – in many cases three to four years.

There are also concerns that whilst the number of actual houses granted permission is rising, the number of sites they are on continues to drop, an indication that bigger sites are increasingly being allocated. The industry needs to see a mix of site sizes being given permission and is urging local authorities to allocate more smaller sites, a move that would help smaller builders in particular and lead to increases in both the number of homes being built and industry capacity.

‘Stepping up’ also explores the other economic benefits that Help to Buy is bringing to communities around the country. The 39,813 homes delivered through the scheme in the year to April supported 170,000 jobs both directly and indirectly, generated £63m towards spending on education (enough to support 15,000 school places) and £51m in Council Tax for local councils.

Stewart Baseley, Executive Chairman of the Home Builders Federation said:

“These record planning permission figures are a clear indication that housebuilders are committed to increasing housing output. We’ve seen 50% growth in output over the last three years and these figures indicate that progress can continue.

“The Help to Buy scheme hasn’t just helped 200,000 people buy a home; it has helped them to buy a new build home which is, in turn, boosting supply and generating huge benefits for communities, councils and the Exchequer.

“While the availability of mortgages has improved since 2013, without Help to Buy, a first-time buyer would once again be forced to find tens of thousands of pounds just to fund a deposit.

“Ultimately If people can buy, builders can build and confidence in demand is crucial to future build rates. The figures show that if demand for new homes remains strong and the planning system processes applications efficiently, further increases in build rates can be delivered in the coming years.

“We need to see confirmation from Government as to the future of the very successful Help to Buy scheme post 2021. We also need to see the proposals to improve the planning system outlined in the White Paper moved forward and implemented.

“The industry has demonstrated its commitment to increase output. We now need to see decisive policy decisions that will enable the ambition to build more to be delivered.”

Glenigan’s Economics Director, Allan Wilen, commented, “The residential development pipeline continues to strengthen. The number of new homes securing planning approval during the first half of 2017 was 22% up on a year ago. The increased supply of sites available for development demonstrates housebuilders confidence about market prospects with the industry well placed to meet the demand for new homes.”

Graph 1

Graph 2

For media enquiries, or to arrange an interview, please contact Steve Turner on 020 7960 1606 or 07919 307760. Steve.turner@hbf.co.uk

Notes to editors

- The Home Builders Federation (HBF) is the representative body of the home building industry in England and Wales. The HBF’s member firms account for some 80% of all new homes built in England and Wales in any one year, and include companies of all sizes, ranging from multi-national, household names through regionally based businesses to small local companies: www.hbf.co.uk

- Glenigan is the UK’s leading provider of construction data, contract leads and construction market analysis. Combining comprehensive data gathering and exhaustive research with detailed statistical modelling and expert analysis, it delivers a trusted insight into UK construction trends and activity.

- The housing approvals data analysed in this report is drawn from Glenigan’s extensive database of current and planned construction projects. Glenigan’s detailed coverage of planned housing projects across the UK offers valuable strategic and tactical insights into developers’ active sights and pipeline, with sites tracked through to completion. www.glenigan.com

- ‘Permissions’ are measured when the first ‘reserve matter’ attached to the consent is approved. Before an ‘implementable’ permissions is granted that allows work to start on site, a planning obligations (S106) agreement will almost always have to be agreed and signed and all pre-commencement planning conditions attached to the permission have to be discharged. Some permissions will have up to 100 conditions attached.

- Housing supply – new dwellings, conversions and changes of use (such as office to residential) reached 200,070 in 2015/16. Factoring in demolitions, net supply – the measure on which the Government’s ‘1M in this Parliament’ target is based on, was 189,650. Of these 163,940 were new build homes, up 38% in past 3 years.

- Housing Pipeline shows permissions granted on all sites. Previous versions did not include numbers for sites of under 10 units. All historic figures have been adjusted to reflect the change in methodology