Last updated: 17 Dec 2024

An examination of the crisis in s106 Affordable Housing

Contents

- Introduction

- Why is RP interest in S106 Affordable Housing declining?

- Remediation works

- Inflation and rising cots

- Falling interest cover

- Rent increase limit

- Reduced cashflow

- Grant funding

- Capacity

- Accessing the market for S106 Affordable Housing

- How many S106 units with detailed planning permission are currently uncontracted?

- How many sites are currently delayed due to uncontracted S106 units?

- What impact is this having on developers?

- In which regions are challenges being experienced?

- Conversion of S106 units

- Broader impacts

- Undermines efforts to tackle the housing crisis

- Fails those most in need of a new home

- Thwarts attempts to help more First Time Buyers (FTBs) on to the housing ladder

- Potential solutions

Introduction

Private sector housing delivery is now responsible for around 44% of all new Affordable Homes through Section 106 (S106) developer contributions.

Indeed, in the past five years alone, almost 140,000 (138,606) new Affordable Homes have been delivered through private sector cross-subsidy with developers contributing around £10.8bn towards affordable housing provision, infrastructure and amenity enhancements each year.

However, the future supply of this much needed tenure is under threat, with many home builders finding it increasingly difficult to fulfil their S106 Affordable Housing requirements due to a lack of bids from Registered Providers (RPs).

Although this issue has been developing over several years, it has only gained significant prominence in the home building industry within the past 12 months. In response, the HBF conducted a survey in March 2024 among 13 of its members to better assess the potential scale of the problem.

The results found that there were almost 13,000 (12,888) S106 units with detailed planning permission that were uncontracted.

Since then, anecdotal reports from developers have indicated that the situation remains critical. Consequently, HBF conducted a follow-up survey in October 2024 with a broader group of members. This survey, covering 31 developers, revealed the following:

- At least 17,432 Section 106 affordable housing units with detailed planning permission remain uncontracted.

- Across the country, 139 home building sites are currently delayed due to uncontracted Section 106 units.

Nine of the 31 developers participated in both surveys, allowing a direct comparison of changes since March. The data revealed that:

- In March 2024, these nine developers reported a total of 12,017 uncontracted Section 106 affordable housing units.

- By October 2024, this figure was 12,230—an increase of 1.8%.

- The number of delayed sites rose sharply from 27 in March 2024 to 110 by October 2024 - an increase of 307%.

The remainder of this report will examine these results in more detail, establish the background to the issue and identify potential measures that industry and Government can take to overcome this challenge.

Why is RP interest in S106 Affordable Housing declining?

The past two years has seen a gradual reduction in the number of Registered Providers (RPs) actively participating in the market to acquire Section 106 Affordable Homes. This is due to a ‘perfect storm’ of economic and policy challenges:

Remediation works

RPs are having to invest heavily in building safety remediation, tackling damp and mould issues and decarbonising and modernising existing stock. While these actions are vital for the health, safety and wellbeing of residents, they nevertheless come at a significant financial cost for the sector.

Indeed, research has found that repairs and maintenance expenditure across the sector has increased by over £1.5billion in just four years. Such significant spending is expected to continue with expenditure on repairs and maintenance forecast to reach £50bn over the next five years, the equivalent of 43% of social housing lettings turnover.

These issues, combined with the introduction of Tenant Satisfaction Measures which focuses on matters such as the landlord’s ability to keep properties in good repair and maintain building safety, mean that any available reserves are being targeted at asset management issues rather than investment in new stock.

Inflation and rising costs

In common with the broader house building industry, RPs have faced challenges as a result of the economic uncertainty of the past two years. High levels of inflation have been a particular concern, with many RPs struggling with the resulting increases in insurance and maintenance contractor costs.

The rising cost of debt has caused further concern. RPs use debt (secured against stock) to fund growth and are obliged to maintain liquidity to fund at least 18 months of operation. While some is at a fixed rate, the changes in interest rates have made that debt more expensive. With the larger Providers having debt running into the billions, the additional cost of servicing that debt and maintaining covenants is significant.

While inflation and interest rates are now heading in the right direction, interest rates are unlikely to fall back to the historic lows seen over much of the past decade. As such, theRegulator of Social Housing (RSH) has warned “The challenge of balancing stock decency and remediation requirements with the need to invest in decarbonisation measures and the construction of new homes will continue”.

Falling interest cover

Interest cover is a metric that is used to assess the financial viability of Registered Providers. While interest cover performance has been declining in the sector since 2018, it has worsened considerably in recent years with RP interest cover falling below 100% in 2023/24, the first time since 2009 that the cost of servicing debt exceeded net earnings.

Looking ahead, the sector’s forecast aggregate EBITDA MRI interest cover over the next five years has fallen to 111% (FFR 2024), down from 125% in 2023 and 190% in 2018. Perhaps most concerningly, over a quarter of PRPs forecast aggregate interest cover over the next five years below 100%, including 12 of the 17 PRPs with more than 40k units.

Rent increase limit

In April 2023, the then Conservative Government introduced a 7% cap on social housing rent for the 2023-24 financial year. While understandable given the cost-of-living crisis, it provided another fiscal challenge for RPs at a time when the costs of maintaining and improving their existing stock were rising significantly. Indeed, some have suggested that it will result in a £3.2billion loss in rental income for registered providers.

However, with the National Housing Federation (NHF) reporting that social housing rents fell by 15% in real terms between 2015-2024, it is evident that the concerns regarding rental income have been many years in the making but have been exacerbated by the recent economic climate.

Income from social housing rents is vital to RP’s ability to purchase new social homes. While it was positive to see the new Labour Government confirm in its first Budget (30 October 2024) that it will consult on a new long-term social housing rent settlement of CPI+1% for five years, for a sector that relies on long-term certainty, moving to a 10-year settlement would be preferable.

Reduced cashflow

Cashflow, unsurprisingly, is also a challenge for the sector with the Regulator of Social Housing’s (RSH) quarterly survey of more than 200 large providers finding that cash balances (£3.9bn) had reduced to their lowest level in over ten years and were set to reduce further to £2.7bn by June 2025.

Grant funding

RPs are increasingly choosing to buy land and tailor schemes towards their own requirements over purchasing S106 stock. Primarily this is because it enables RPs to access grant funding through the Government’s Affordable Homes Programme, which they typically cannot use on S106 units. Given the financial difficulties the sector is facing, this is understandable.

However, some RPs also value the greater control that comes with land-led schemes as it enables them to tailor the design, construction, and management of the housing units to meet its own specific needs and standards and reduces the risk of the need for costly retrofitting works later on.

Capacity

Due to capacity issues, many RPs, especially the larger ones, are concentrating on sites where they can deliver large numbers of affordable homes. Some commentators have suggested that “Most RPs have a minimum threshold of 20 homes, with the larger RPs not interested in delivering less than 100 homes”.

As such, this presents a particular challenge for SME developers who by their very nature are focused on smaller sites which in turn generate fewer S106 affordable homes.

Assessing the market for S106 Affordable Housing

In 2024, HBF conducted two surveys of a small selection of its membership to better understand the challenges developers were experiencing in obtaining bids from RPs for their S106 Affordable Housing units.

The first survey was conducted in March among 13 developers and found:

- almost 13,000 (12,888) Section 106 units with detailed planning consent were uncontracted as of March 2024.

- Around 10% of these plots were due for completion during 2024 with a further 27% expected to complete during 2025.

In the months following the survey, it appeared, at least anecdotally, that the problem was worsening. As such, in October 2024 HBF decided to repeat the survey among an expanded group of members. The results of this survey are outlined in the remainder of this section.

How many S106 units with detailed planning permission are currently uncontracted?

In total, 31 developers of various sizes and locations responded to the survey. The results found:

- 17,432 S106 Affordable Housing units with detailed planning consent remain uncontracted.

- To put this into perspective, this is equivalent to almost two thirds(63%) of the total number of Affordable Homes funded through S106 agreements in 2023-24.

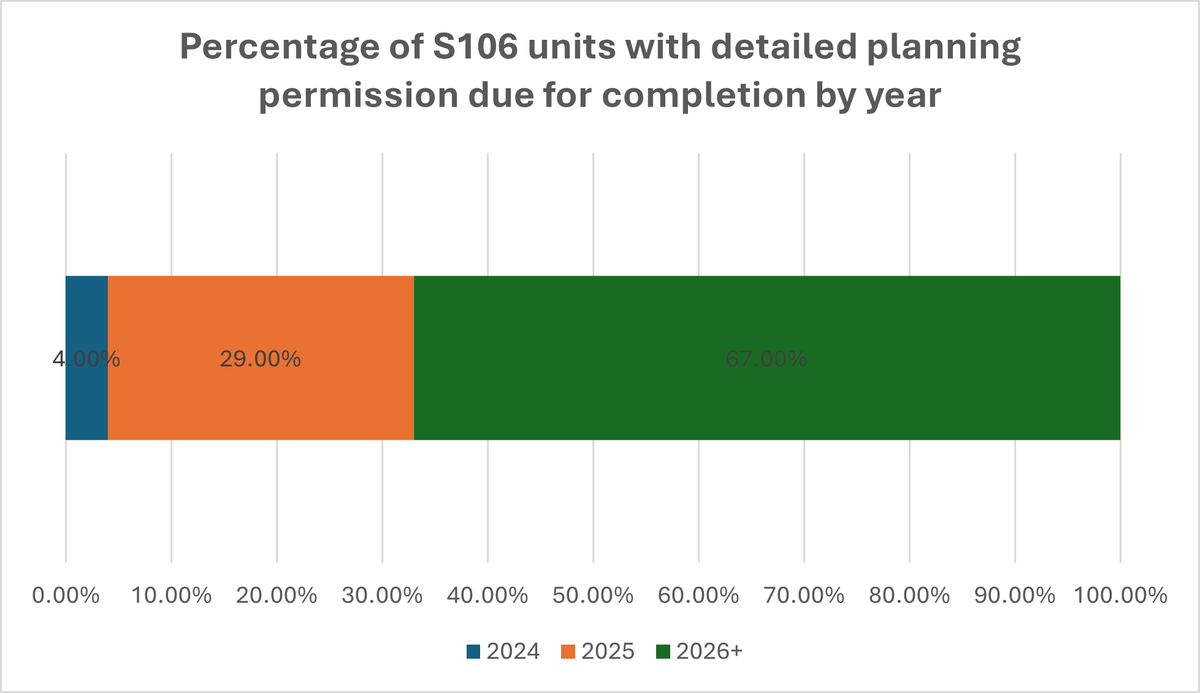

- Of the uncontracted units, at the time of the survey:

- 4% are due for completion in 2024

- 29% are due for completion in 2025

- 67% are due for completion from 2026 onwards

Of the 31 developers that responded to our October survey, nine had also participated in the original survey which ran in March 2024. To better understand how the scale of the challenge had changed during this period, the data provided by these nine companies was compared. The results showed:

- In March 2024, these nine developers collectively reported that they had 12,017 S106 Affordable Housing units with detailed planning consent uncontracted.

- By October 2024, this number had increased by 1.8% to 12,230 units.

How many sites are currently delayed due to uncontracted S106 units?

Across the 31 developers that provided data, there are currently 139 sites that are delayed across the country due to uncontracted S106 units. Others are at risk of stalling as the developer is close to the threshold of how much open market housing can be constructed before S106 units are delivered.

As was anticipated, the results showed that the number of delayed sites is also increasing:

- Among the nine developers who participated in both surveys, the number of delayed sites rose sharply from 27 in March 2024 to 110 by October 2024 - a substantial increase of 307%.

“The reality is all our sites are being delayed because of this issue” – Survey respondent

“We only have one site delayed, but as an SME that is a major issue” – Survey respondent

What impact is this having on developers?

Beyond site delays and developers re-evaluating the pace and direction of their building programs, home builders have reported various other impacts from this issue—some of which pose serious threats to the future of their businesses and housing output. These include:

- Some developers are opting to starting work on site without a RP contract in place which comes with considerable risk.

- Financial targets are being missed undermining the prospects for future investment.

- Home builders scaling back their plans for future site acquisitions and opting not to build in certain areas as it is not financially viable.

“They (the council) have now agreed in principle a revision to the tenure to a 50/50 split between Social Rent & Shared Ownership and a delay to the delivery dates within the s106 agreement which will at least enable us to start on site. There is still significant risk to us though as we do not yet have an HA to take the units (even on the revised mix) and may mean we have to pause development once on site which will have a significant financial impact” – Survey respondent

“In addition to the impact on current developments, the lack of RP bids is affecting the viability of potential site acquisitions and will suppress housing output in future years” – Survey respondent

“I am reaching the conclusion that some areas in our operating area are simply not viable to build in it is far too difficult” – Survey respondent

Although this issue affects developers of all sizes, it presents particular challenges for SME home builders. Many of these builders depend on project-based financing to support cash flow and initiate construction, but they cannot access these funds without a contract in place to sell the Section 106 homes to RPs or councils.

For some SME developers, this is an insurmountable problem and may thus prove to be the final nail in the coffin for a number of businesses.

In which regions are challenges being experienced?

In terms of geography, the issue is not confined to certain areas of the country with HBF members reporting challenges in all regions of England.

However, the South East and London is facing some particularly acute challenges. For example, one company suggested “Low rise buildings appear to attract a lot more interest, whereas and high-density developments and particularly high-rise buildings attract virtually no interest at all. This obviously means that London developments are particularly at risk of receiving little to no interest from RPs for the nil grant s106 units and subsequently the RP’s approach is serving to stifle development in London and in our view making many developments unviable”.

Figures from the G15, a consortium of London’s largest RPs, supports this with the data demonstrating that among this group the total number of affordable starts on site dropped by two-thirds between the 2020/21 and 2023/24 financial years, to 2,031. For S106 schemes specifically, starts dropped 76% to just 549.

Conversion of S106 units

The challenges in the current market are encouraging developers to utilise cascade agreements in S106 agreements as a means of overcoming a lack of bids from RPs.

A cascade agreement allows for the affordable housing outputs to be changed – for example, if there is no interest from RPs in the proposed affordable dwellings within a certain timeframe then this can be changed to an alternative tenure or to a commuted sum in lieu of affordable housing which can be delivered elsewhere by the local authority.

However, cascade agreements are not a silver bullet to the problem as:

- some developers purchase sites with the S106 agreement already in place.

- not all LPAs are open to the use of cascade agreements.

- the process of agreeing a cascade agreement can take many months of negotiations with LPAs, placing further pressure on under resourced planning departments and adding delays to an already protracted planning process.

- the timing delays cannot always be accommodated and/or it can jeopardise a positive decision.

“We have had to engage local planning authorities to discuss alternative tenures such as discounted market units due to there being no interest in S106s in this region at the present time. This strategy will require deed of variations to existing S106 Agreements so has timing and cost implications” – Survey respondent

Regardless, for many developers the use of cascade agreements, where permitted by the Local Authority, is sometimes the only option available to ensure that it can fulfil its Affordable Housing obligations.

From the data that was provided in response to the original survey (March 2024), we are aware of at least 606 S106 rented homes, 193 S106 Affordable Rent Homes and 159 S106 Shared Ownership Homes that have been converted to other tenures in the past 12 months.

Many of these units have been converted to either First Homes or Rentplus. While these are both valuable tenures, there is a significant need for more social rented and Affordable Rent Homes and so any loss of units from this tenure is concerning.

To put this into context, 3,531 social rent units were completed in 2022-23 through S106. The 606 S106 rented homes that we know have been lost in the past 12 months is equivalent to 17% of last year’s social rent completions.

Broader impacts

Beyond the immediate consequences for developers, the challenging market home builders are facing for S106 Affordable Homes is concerning for a number of reasons:

Threatens industry’s ability to meet housing targets

Home builders are facing an ambitious Government target of delivering 1.5 million new homes over the course of the Parliament.

With housing delivery already constrained by a number of factors including nutrient neutrality (currently blocking the delivery of around 160,000 new homes) and delays in the planning process, the Section 106 issue is pushing this challenging ambition even further from reach due to the increasing number of sites being delayed or paused.

Undermines efforts to tackle the housing crisis

The country is facing a worsening housing crisis on all front fronts. Indeed, HBF published research last year that found England has:

- far fewer dwellings relative to its population than other developed nations we typically consider peers, with 434 homes per thousand inhabitants, significantly fewer than France (590), Italy (587) and the OECD average of 487.

- amongst the oldest housing in Europe, with 78% of UK homes having been built before 1980, compared with an EU average of 61%, and 38% of the UK’s housing stock being built before 1946, compared with an EU average of 18%.

- the highest proportion of substandard homes in Europe, and significantly higher than many other countries including Germany (12%), Bulgaria (11%), Lithuania (11%) and Poland (6%).

- pushed an average of 934,000 people into housing overburden each year in the UK in the six years between 2012 and 2018.

Yet, with delivery hindered by this issue—and increasing housing supply essential to addressing the housing crisis—the industry’s efforts to resolve the problem meaningfully are being significantly undermined.

Fails those most in need of a new home

Most importantly, this issue is preventing industry from providing those most in need of a home at a time when demand is increasing substantially:

- 1.29 million households were on local authority social housing waiting lists as of 31 March 2023, an increase of 6% compared to 31 March 2022 and the highest it has been since 2014.

- Average UK private rents increased by 8.4% in the 12 months to September 2024. While this was below the record-high annual rise of 9.2% in March 2024, private enters are nevertheless facing an extremely challenging situation.

- On 31 March 2024, 117,450 households were in temporary accommodation, up 12.3% from the same period last year.

Thwarts attempts to help more First Time Buyers (FTBs) on to the housing ladder

As highlighted earlier in this report, England has struggled for decades to build enough homes to meet demand. Any delays to new construction will only worsen the already limited supply, further reducing options for first-time buyers (FTBs) and exacerbating challenges in an already difficult housing market.

Compounding this issue, for the first time in 60 years, there is no effective government support for homeownership. Without such support, many aspiring first-time buyers will remain locked out of the market, unable to take their first step onto the property ladder.

Potential solutions

Concerns regarding the challenging marketplace for S106 Affordable Housing units are held not only by developers but by Government too.

Indeed, in response to a Parliamentary Question from the Conservative MP, Sir Ashley Fox, on 28 October about the impact the problem was having on developers and people in his constituency, the Deputy Prime Minister, Angela Rayner, said:

“I am aware of those concerns, and the Government will continue to work with house builders, local authorities and affordable housing providers to tackle the problem”.

Finding a solution will not be easy and will likely involve several short-term and more medium-term solutions if we are to tackle the issue most effectively. These could include, but are not limited to, the following:

Encouraging a greater acceptance of cascade agreements by Local Planning Authorities (LPAs) which could be achieved via a Written Ministerial Statement (WMS) from the Government

In the short-term, this solution is the one that will be of most practical help to developers as it will ensure homes can continue to be built and give reassurance to the developer that if an RP cannot be found, that the Affordable Homes can be changed to an alternative tenure or as last resort, a payment made to the LPA in lieu of the Affordable Housing.

Where possible, developers are working with LAs to negotiate cascade agreements but at present not all are open to their use. As such, a direction from the Government to LPAs is needed to ensure that all developers can benefit from such flexibility if needed.

Greater and earlier collaboration between developers and RPs

Where feasible, developers could look to involve RPs much earlier on in schemes, potentially even at the design stage, to help ensure that S106 Affordable Housing units meet the specifications that RPs are looking for and thus making any proposal more attractive.

Some developers have also found success by offering additionality on schemes which the RP is then able to use grant funding on.

Enable Homes England grant funding available for use on S106 units for a time limited period

As outlined previously in this report, many RPs are choosing to focus solely on grant-funded units due to the strain on their finances. Following the injection of an additional £500m of funding into the 2021-2026 Affordable Homes Programme at the autumn 2024 Budget, the Government, working with Homes England, may wish to consider whether grant funding could be made available for use on S106 units for a time-limited period.

By allowing RPs to ‘top up’ their bids with grant funding, a bit of breathing space would be created in which a longer-term solution could be sought, while also ensuring that much needed affordable new homes are not lost in the immediate to medium term.

Rebuild the financial capacity of the RP sector

The home building industry is working closely with our colleagues in the RP and Local Government sectors, both of whom shares developers’ frustrations with the current situation, to communicate to Government the actions needed to give RPs the confidence and capability to invest.

To this end, a joint letter from HBF and the National Housing Federation (NHF) was sent to the Chancellor of the Exchequer, Rachel Reeves, ahead of the Budget making the case for a long-term rent settlement of CPI+1% annual rent increases (undoing the real terms cuts of recent years) and the reintroduction of convergence; funding to invest in existing homes; a boost to the current Affordable Homes Programme; and new long-term grant funding for new social homes. As such, the Government’s subsequent confirmation that it would be injecting an additional £500 million into the current Affordable Homes Programme and consulting on a new 5-year social housing rent settlement was very welcome.

However, with the Government committed to outlining further information about its investment in Affordable Housing at the forthcoming Spending Review, and the possibility of a move to a ten-year rent settlement, there is still some time to wait until the sector is given complete clarity.